Use Buy Now Pay Later To Grow Your Online Business

The world of retail is changing fast. Buy now pay later is the biggest consumer trend that you won’t want to fall behind on.

By offering your customers a buy now pay later (BNPL) payment option, you can maximize sales and total checkout value.

Platforms Partners

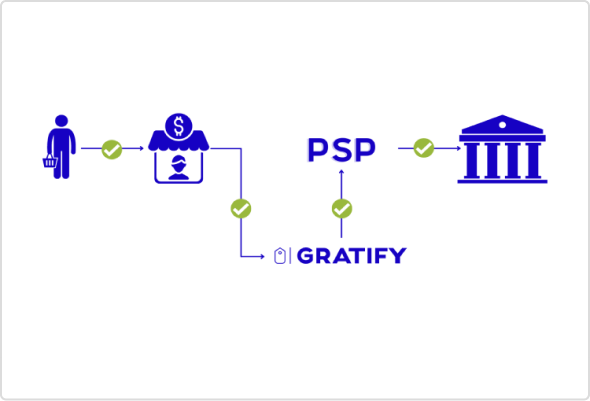

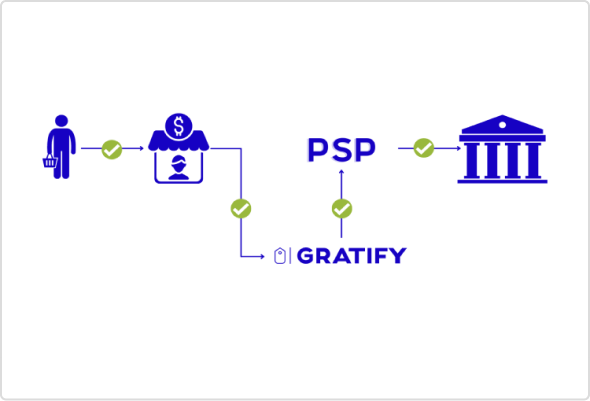

How BNPL Works

It’s consumer lending made easy, and effortless for you to integrate into your store.

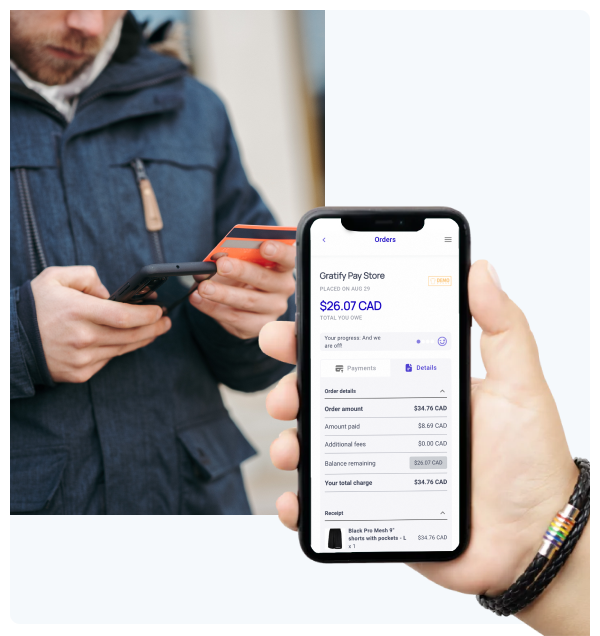

Customer pays in 25% installments

Your customers can easily make a purchase on your website and choose Gratify as their preferred payment method at checkout. Interest free.

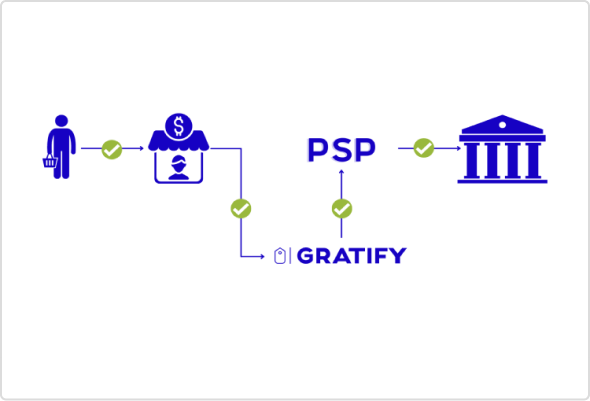

Customer pays in 25% installments

Your customers can easily make a purchase on your website and choose Gratify as their preferred payment method at checkout. Interest free.

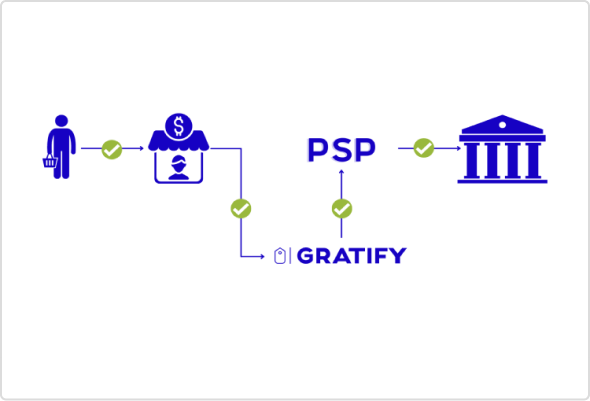

Customer pays in 25% installments

Your customers can easily make a purchase on your website and choose Gratify as their preferred payment method at checkout. Interest free.

48% Of Your Customers Want BNPL

48% of consumers saying BNPL would empower them to spend 10-20% more compared to using a credit card. GratifyPay empowers both you and your customers with more flexibility, increased purchasing power, and higher order values.

Get Started Using Buy Now Pay Later In Your Online Store

Create your merchant account in less than 10 minutes through our online portal. We’ll walk you through how easy GratifyPay is to use with a quick demo.

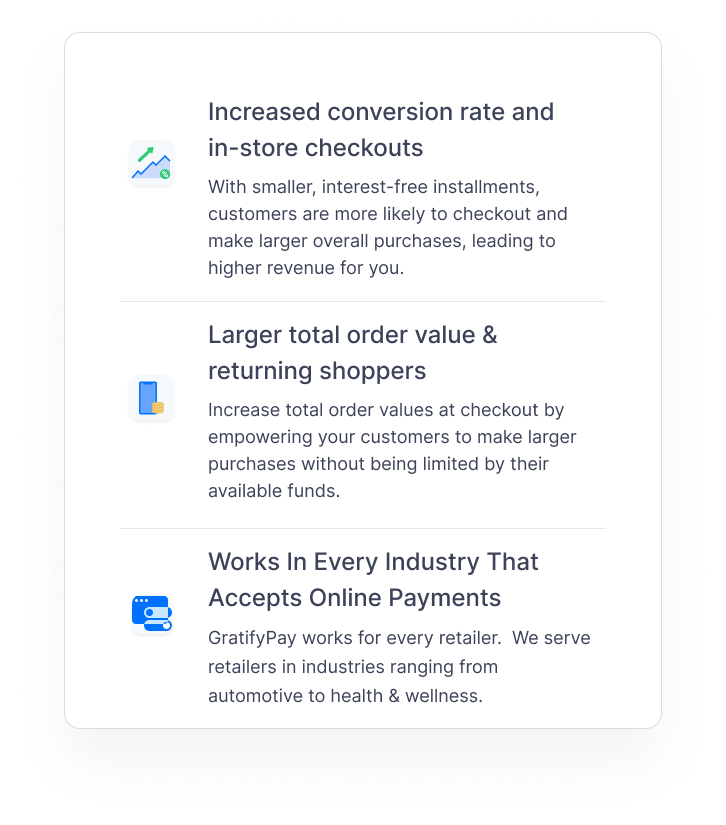

Better Payment For Merchants & Consumers

Retailers who adopt early will be able to tap into a wider market of consumers who are looking for convenient and flexible payment options.

BNPL Accelerates Online Growth And Streamlines Consumer Lending

Instead of dealing with high interest rates, buy now pay later offers a better way for consumers to buy what they want, when they want it, without having to wait.

That also means 10-20% more purchases at checkout, lower returns & charge backs, without having to deal with the financing

BNPL Accelerates Online Growth And Streamlines Consumer Lending

Instead of dealing with high interest rates, buy now pay later offers a better way for consumers to buy what they want, when they want it, without having to wait.

That also means 10-20% more purchases at checkout, lower returns & charge backs, without having to deal with the financing

Better Payment For Merchants & Consumers

Retailers who adopt early will be able to tap into a wider market of consumers who are looking for convenient and flexible payment options.

BNPL Accelerates Online Growth And Streamlines Consumer Lending

Instead of dealing with high interest rates, buy now pay later offers a better way for consumers to buy what they want, when they want it, without having to wait.

That also means 10-20% more purchases at checkout, lower returns & charge backs, without having to deal with the financing

BNPL Accelerates Online Growth And Streamlines Consumer Lending

Instead of dealing with high interest rates, buy now pay later offers a better way for consumers to buy what they want, when they want it, without having to wait.

That also means 10-20% more purchases at checkout, lower returns & charge backs, without having to deal with the financing

What Other Online Retailers Are Saying About Gratify

"I can't believe how easy it was to get setup!"

"I can't believe how easy it was to get setup!"

Use Buy Now Pay Later To Grow Your Online Business

The world of retail is changing fast. Buy now pay later is the biggest consumer trend that you won’t want to fall behind on.

By offering your customers a buy now pay later (BNPL) payment option, you can maximize sales and total checkout value.

.png?width=570&height=476&name=div%20(1).png)

FAQ

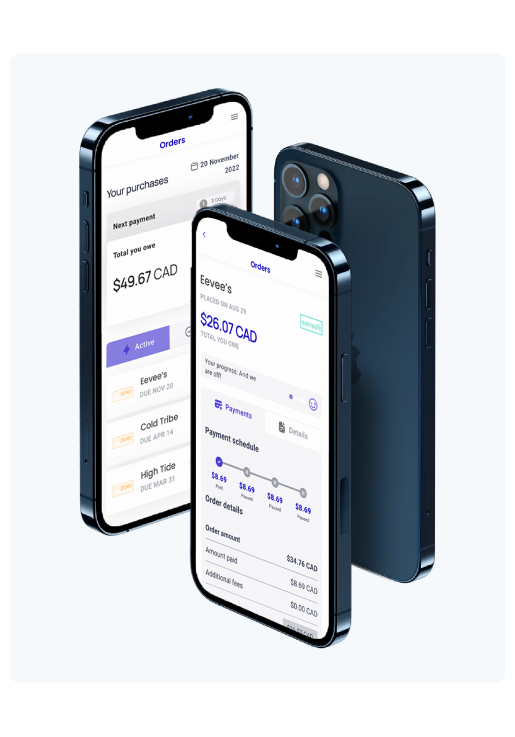

How do customers use Gratify to pay?

Gratify appears as a small box next to “payment options” on your checkout page. We provide all the tools you need to integrate our Buy Now Pay Later solutions and set up your business to offer deferred payment options, offer pre-qualification, and add Gratify Pay to your checkout portal.

How do customers use Gratify to pay?

Gratify appears as a small box next to “payment options” on your checkout page. We provide all the tools you need to integrate our Buy Now Pay Later solutions and set up your business to offer deferred payment options, offer pre-qualification, and add Gratify Pay to your checkout portal.

How do customers use Gratify to pay?

Gratify appears as a small box next to “payment options” on your checkout page. We provide all the tools you need to integrate our Buy Now Pay Later solutions and set up your business to offer deferred payment options, offer pre-qualification, and add Gratify Pay to your checkout portal.

How do customers use Gratify to pay?

Gratify appears as a small box next to “payment options” on your checkout page. We provide all the tools you need to integrate our Buy Now Pay Later solutions and set up your business to offer deferred payment options, offer pre-qualification, and add Gratify Pay to your checkout portal.

How do customers use Gratify to pay?

Gratify appears as a small box next to “payment options” on your checkout page. We provide all the tools you need to integrate our Buy Now Pay Later solutions and set up your business to offer deferred payment options, offer pre-qualification, and add Gratify Pay to your checkout portal.